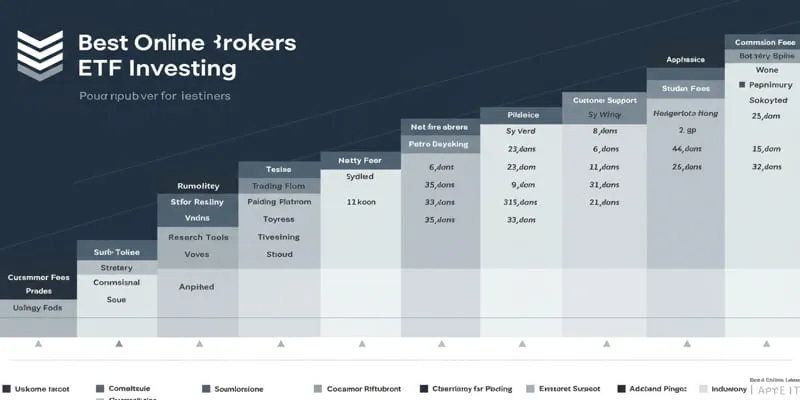

Best Online Brokers for ETF Investing

The Best Online Brokers for Investing in ETFs: Choose the right platform for your ETF investment journey. Selecting the right brokerage platform is crucial to success in exchange-traded funds. This comprehensive guide will help you explore your options and find the ideal broker that fits your investment goals. We’ll focus on key aspects like research tools, ETF selection, and user experience to determine which online brokers are best for ETF investors. Whether you’re a beginner or an experienced trader, this article will provide the knowledge you need to make informed decisions and optimize your ETF portfolio.

Why Invest in ETFs?

Exchange-traded funds, or ETFs, have rapidly become popular investments for numerous reasons. These versatile investment vehicles offer unique benefits, making them appealing to both novice and seasoned investors.

Diversification Made Easy

One of the primary benefits of ETFs is instant diversification. When you invest in an ETF, you gain exposure to a variety of securities. This diversification spreads risk across different assets, providing a more secure and confident investment strategy.

Cost-Effective Investing

Most ETFs have lower expense ratios than actively managed mutual funds. This cost efficiency allows you to retain more of your returns, as fees consume less of your investment. Additionally, because ETFs trade like stocks, you can buy and sell at market prices with lower transaction costs than other investment options. This makes you a financially savvy and prudent investor.

Flexibility and Liquidity

Unlike mutual funds, which are priced once a day, ETFs can be traded at any time during the market day. This flexibility allows you to quickly respond to market changes or adjust your investment strategy, giving you full control over your investments.

Factors to Consider When Choosing an Online Broker for ETF Investing

When selecting an online broker for ETF investing, consider several essential factors to ensure the platform aligns with your investment goals and trading style.

Commission and Fee Structure

Review the broker’s fee schedule. Some offer commission-free ETF trades, which can lead to significant savings over time. Additionally, be aware of other fees, such as account maintenance charges or inactivity fees, that can impact your overall costs.

ETF Selection and Availability

Having a variety of ETFs in your portfolio is crucial for diversification. Your broker should offer a wide selection of ETFs covering multiple sectors, asset classes, and geographical locations. This enables you to make informed choices with extensive diversification options.

Research Tools and Educational Resources

Robust research and educational tools enhance your ETF investing experience. Look for brokers that provide in-depth ETF screeners, detailed fund analysis, and real-time market data. Educational materials like webinars, articles, and tutorials can help you make better financial decisions.

User Experience and Platform Functionality

Consider the broker’s user interface and overall functionality. A user- friendly platform with intuitive navigation can streamline your trading process and improve efficiency. Mobile app availability is also essential for investors who prefer managing their portfolios on the go.

Top Online Brokers for ETF Investing

Fidelity Investments

Fidelity is a top choice for ETF investors, offering a comprehensive platform with zero commissions on ETF trades, ease of use, and strong research tools. It caters to both beginners and sophisticated investors, providing an unparalleled selection of commission-free ETFs, including their lineup of zero-expense-ratio index funds.

Charles Schwab

Charles Schwab stands out with some of the best ETF research and screening capabilities. They offer a vast array of commission-free ETFs, including low- cost options. For investors seeking curated selections based on specific criteria, Schwab’s ETF Select List is hard to beat.

Vanguard

Vanguard is a leader in index investing and is ideal for long-term ETF investors. While its platform may not be flashy, it offers some of the lowest expense ratios available. All ETFs traded on the company’s platform are commission-free, making it a cost-effective option for buy-and-hold strategies.

Interactive Brokers

For sophisticated investors, Interactive Brokers offers extensive choices in global ETFs. Their broad exposure to international markets places them among the leading brokers with advanced trading platforms and competitive pricing for active traders. However, due to the complexity of its interface, Interactive Brokers may not be suitable for beginners.

Comparing Commissions and Fees for ETF Trading

Understanding the fee structure is crucial when choosing an online broker for ETF investing. Commissions and fees can significantly impact your returns, especially for frequent traders or those with smaller portfolios.

Commission-Free ETF Trading

Many brokers now offer commission-free trading in ETFs, which is highly appealing to cost-conscious investors. This allows you to buy and sell without incurring transaction fees that can add up over time. However, it’s important to consider other aspects beyond commission-free offerings.

Expense Ratios and Other Fees

While commission-free trading is attractive, don’t overlook the ETF’s expense ratio, an annual fee charged by the fund. Expense ratios can vary significantly between different ETFs. Additionally, some brokers may charge account maintenance fees, inactivity fees, or transfer fees. Always read the fine print to understand the total cost of investing with a broker.

Platform Fees and Account Minimums

Some brokers charge platform fees for advanced trading tools or research, which can be valuable if used frequently. Additionally, brokerages often require a minimum balance in your account to access certain services and tools. Consider whether these align with your investment goals and available capital.

Conclusion

Choosing the right online broker for ETF investing is arguably the most critical step in your investment journey. Consider your investment goals, trading frequency, and the features that matter most to you. While some brokers focus on low fees, others emphasize research tools or user- friendliness. Ultimately, there’s a suitable online broker for everyone’s needs.