Line of Credit vs. Credit Card

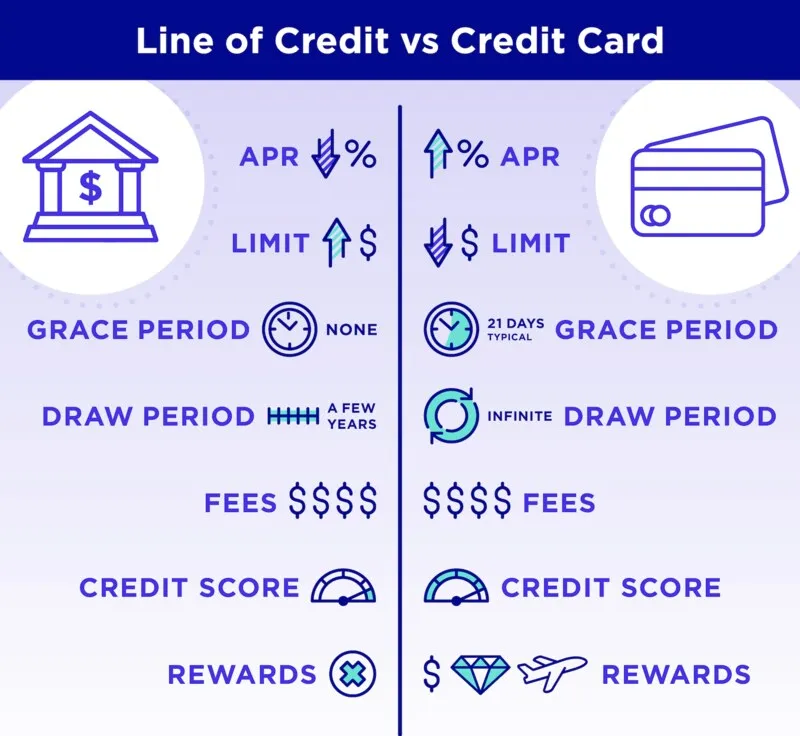

In today’s financial landscape, consumers frequently encounter various credit options designed to meet diverse needs. Two common forms are lines of credit and credit cards; both offer financial flexibility but operate in distinct ways. A line of credit provides the ability to borrow against a predetermined limit set by the lender, usually granting access to funds as needed. Conversely, credit cards offer a revolving credit line tied to the card itself, allowing users to make purchases up to a specified limit. This article explores the nuances of these two financial tools, shedding light on their advantages, disadvantages, and strategic uses.

Differences in Structure

The fundamental difference between a line of credit and a credit card lies in their usage and structure. A line of credit functions similarly to a personal loan but offers greater flexibility regarding borrowing and repayment. You can draw from the limit as needed and only pay interest on the amount withdrawn. This setup is particularly useful for managing cash flow or financing large expenses, like home renovations. On the other hand, a credit card’s primary purpose is for purchases. Users can spend up to their credit limit and generally need to make monthly payments to avoid interest charges on the remaining balance. This structural difference can influence how individuals choose to utilize these financial products.

- Flexibility : Lines of credit can be tailored to the borrower’s needs, making them suitable for variable expenses.

- Credit Utilization : Credit cards can impact credit scores based on how much of the limit is used at any given time.

Interest Rates and Fees

The overall cost of borrowing is significantly influenced by the different interest rates and fees associated with credit cards and lines of credit. Lines of credit often have lower interest rates than credit cards, making them a potentially cheaper option for larger loans or extended borrowing periods. However, it’s crucial to consider additional charges, such as annual fees or maintenance costs, that could increase the total expense. Conversely, credit cards typically have higher interest rates, particularly for cash advances. Moreover, many credit cards offer rewards programs or additional perks that might offset some of these costs. Understanding each specific term and condition is essential for making informed financial decisions.

- Variable Rates : Interest rates on lines of credit can fluctuate, so monitoring market conditions is important.

- Hidden Costs : Be aware of potential fees that can accompany credit cards, such as foreign transaction fees or late payment penalties.

Repayment Terms

Repayment methods differ significantly between credit cards and lines of credit, impacting their overall utility. With a line of credit, borrowers often have the flexibility to repay the principal at their convenience, easing financial strain. Some lines of credit require only interest payments for a specified period, which can be appealing for those seeking short-term financial relief. In contrast, credit cards usually have a fixed billing cycle, requiring at least a monthly minimum payment. Failure to meet these payment obligations can result in late fees and adverse effects on credit records. Therefore, the repayment structure can greatly influence how individuals manage their debts and maintain financial health.

- Payment Strategies : Setting up automated payments can help avoid missed due dates on credit cards.

- Impact of Missed Payments : Late payments can significantly harm credit scores and result in higher interest rates.

Impact on Credit Score

Both credit cards and lines of credit can affect a person’s credit score, but the impact varies based on usage. Responsible use of a line of credit, by keeping balances low relative to the limit and making timely payments, can enhance one’s overall financial reputation. However, frequently approaching the borrowing limit may signal increased risk to lenders, potentially harming the credit rating. On the other hand, credit cards significantly affect credit scores due to credit utilization ratios. A lower utilization ratio generally leads to a more favorable score, while high balances relative to the available credit limit can have a negative impact. Understanding how these instruments influence credit scores is crucial for maintaining financial stability over time.

- Credit Mix : A diverse credit portfolio, including both lines of credit and credit cards, can enhance credit scores.

- Monitoring : Regularly checking your credit report can help identify any errors that may impact your score.

Usage Scenarios

The decision between a credit card and a line of credit typically hinges on individual financial needs and spending habits. For those requiring funds for large, infrequent expenses or ongoing projects with fluctuating costs, a line of credit may be the optimal choice. This option offers the flexibility to borrow only what is necessary, potentially reducing interest costs over time. Conversely, credit cards are more suitable for everyday purchases, allowing users to earn rewards and conveniently manage smaller, recurring expenses. They can also serve as a contingency plan for emergencies or unexpected costs. Assessing personal financial situations will help determine which option aligns better with specific requirements.

- Short-Term Needs : Credit cards can be a quick solution for urgent, smaller expenses.

- Long-Term Planning : Lines of credit may better suit those looking to finance larger projects over time.

Strategic Considerations

When choosing between a credit card and a line of credit, it’s essential to consider your overall financial goals and spending habits. For those seeking financial flexibility, a line of credit can provide economic support without the pressure of stringent repayment schedules. In contrast, using credit cards can aid in building a positive credit history and earning rewards if managed wisely. Additionally, it’s crucial to review the terms, such as interest rates and additional charges, ensuring the choice aligns with your financial strategy. Ultimately, both a line of credit and a credit card can play significant roles in effective financial management. Understanding their differences enables individuals to make informed decisions.

- Financial Goals : Establish clear financial objectives to guide the decision-making process.

- Usage Discipline : Using these tools wisely is crucial to avoid debt accumulation and maintain financial health.

Conclusion

In conclusion, both credit lines and credit cards have unique applications and offer specific benefits that can enhance financial flexibility. Lines of credit provide a more structured borrowing approach, ideal for larger expenses or variable cash flow needs. On the other hand, credit cards deliver convenience and rewards for everyday spending requirements. Understanding the distinctions between these financial instruments is vital for making informed decisions that align with personal goals. By carefully evaluating spending habits and repayment capacities, individuals can effectively utilize either option to manage their financial affairs adeptly and build a robust credit profile. Ultimately, the best choice depends on a comprehensive assessment of one’s financial situation and objectives.