Navy Federal Platinum Card - An Overview

The Navy Federal Platinum Card is a prominent offering from the Navy Federal Credit Union, designed for those seeking a credit card with a low interest rate. Its competitive APR and beneficial features make it an attractive option for anyone looking to reduce financial burdens or finance major purchases. Additionally, the card offers several advantages that increase its value, such as purchase protection and extended warranty services. This article provides a comprehensive analysis of the Navy Federal Platinum Card, discussing its features, benefits, and eligibility criteria to help you determine if it meets your financial needs.

Key Features of the Navy Federal Platinum Card

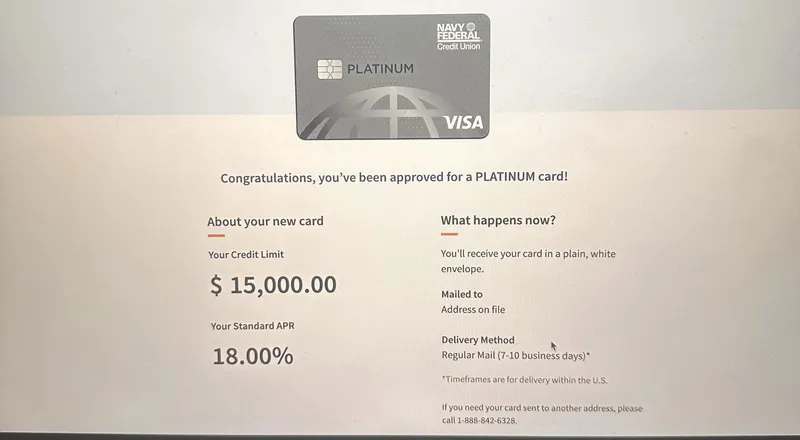

The Navy Federal Platinum Card is renowned for its low APR, appealing to individuals who typically carry a balance from month to month. The card’s standard variable APR is significantly lower than that of many other credit cards, making it a wise choice for reducing interest payments. Moreover, the card has no annual fee, enhancing its appeal compared to other credit cards that charge yearly fees. Another noteworthy feature is the balance transfer option, allowing users to transfer high-interest balances from other credit cards to the Navy Federal Platinum, potentially resulting in long-term interest savings.

Additionally, the card provides features such as fraud protection and 24/7 customer service, offering cardholders peace of mind. Users can also access Navy Federal’s mobile banking and credit card management tools, providing easy ways to monitor and manage their expenses.

- No Foreign Transaction Fees : The Navy Federal Platinum Card does not charge fees for transactions made outside the U.S., making it cost-effective for international use.

- Low Interest on Purchases : The card’s interest rate applies to both new purchases and balance transfers, further enhancing its value.

Navy Federal Platinum Card Benefits

A major benefit of the Navy Federal Platinum Card is its low APR, making it ideal for people who wish to maintain a balance. However, the card also includes additional advantages that appeal to many customers. One such benefit is Visa’s Zero Liability policy, which protects users from unauthorized charges, offering an added layer of security. Additionally, the card provides purchase protection for eligible items, covering them in case of theft or accidental damage.

Cardholders can also enjoy extended warranties on eligible purchases, extending the manufacturer’s warranty by up to one year. This benefit can be particularly useful for expensive items like electronics and home appliances, providing extra peace of mind. Combined, these advantages enhance the value of the Navy Federal Platinum Card, making it an excellent choice for individuals seeking financial flexibility and purchase protection.

- No Annual Fee : Alongside its low APR, the lack of an annual fee sets this card apart from many others in its category.

- Purchase Protection Coverage : Eligible purchases come with protection, which can save you money if an item is lost, stolen, or damaged.

Eligibility for the Navy Federal Platinum Card

To apply for the Navy Federal Platinum Card, certain eligibility criteria must be met. The primary requirement is being a member of the Navy Federal Credit Union, which includes active-duty and retired military personnel, Department of Defense (DoD) employees, and their immediate families. Additionally, applicants must meet credit score requirements, generally ranging from good to excellent. While Navy Federal doesn’t specify a minimum required score, individuals with a rating above 670 generally have a high likelihood of approval.

Prospective applicants should be prepared for a credit check, a standard procedure when applying for credit cards. An existing relationship with Navy Federal, such as having a savings account or prior credit product, may improve your chances of approval.

- Military Connection Requirement : Applicants must be eligible for Navy Federal membership, primarily available to military families.

- Credit Score Considerations : A good to excellent credit score (670+) is typically required to get approved for the card.

How the Navy Federal Platinum Card Compares to Other Credit Cards

Compared to other credit cards on the market, the Navy Federal Platinum Card stands out for its low interest rates and absence of annual fees. Many credit cards, especially those offering rewards or cash back, come with higher APRs and annual fees, which can offset the benefits of such rewards. In contrast, the Navy Federal Platinum is tailored for individuals who prefer not to pay high interest charges and don’t mind foregoing rewards in favor of lower overall costs.

While this card doesn’t offer cash back or points like many other cards, its low interest rate and benefits make it an appealing choice for consumers focused on saving on interest fees. For those with existing credit card debt or planning significant purchases, the Navy Federal Platinum Card provides a straightforward yet affordable solution without the extra charges associated with other credit cards.

- Best for Balance Transfers : With its low APR, this card is ideal for transferring high-interest credit card balances.

- Lack of Rewards : The Navy Federal Platinum Card doesn’t offer cash back or rewards points, which might not suit those looking for perks.

Navy Federal Platinum Card - Who Should Consider It?

The Navy Federal Platinum Card is particularly suitable for individuals who frequently carry a balance and wish to reduce their interest costs. Its low APR and absence of an annual fee provide a solid financial foundation for those needing to finance larger purchases or transfer balances from other credit cards. It’s also advantageous for individuals seeking a credit card that offers strong purchase protections, such as extended warranties and fraud protection.

However, this card may not be ideal for those seeking rewards programs like cash back, points, or travel perks, as it doesn’t offer these benefits. It is designed more for practical use in managing debt and protecting purchases rather than earning rewards. Therefore, individuals who prefer credit cards with extensive rewards might need to look elsewhere.

- Great for Debt Reduction : Best for users who want to manage or reduce credit card debt over time.

- Not for Frequent Spenders : Those who seek rewards or benefits from frequent spending may find this card lacking.

Conclusion

In conclusion, the Navy Federal Platinum Card is an excellent option for those who value low-interest rates, debt management, and purchase protection over rewards or perks. Its lower APR, no annual fees, and helpful features like fraud protection and extended warranties make it an attractive choice for those seeking financial security. However, if you wish to earn rewards from your credit card spending, this might not be the best card for you. By assessing your financial needs and comparing them with various other credit card options, you can determine if the Navy Federal Platinum Card offers the right mix of features to align with your goals.