Pro Forma Financials: What They Are and How They Work

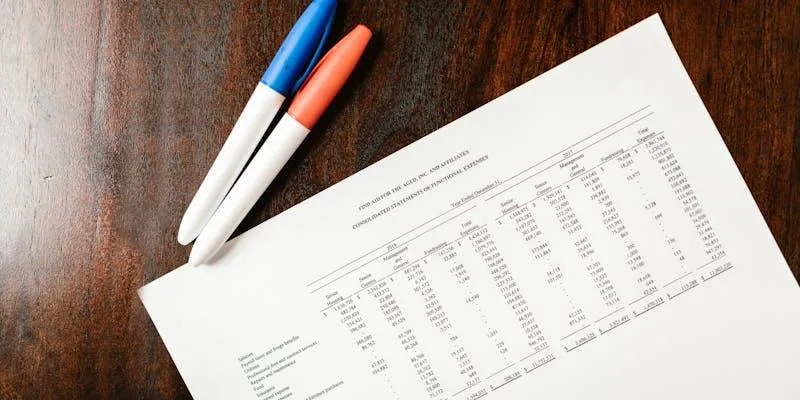

Pro forma , meaning “for form” or “as a matter of form,” refers to financial statements that project or assume future financial outcomes. A proforma financial excludes certain charges, such as merger restructuring costs, deviating from GAAP standards. This approach allows firms to omit factors they believe distort economic forecasts and aids in analyzing future prospects.

Pro Forma Financial Statement Types

Pro forma financial statements are informed by a company’s past performance and future goals, estimating spending and revenue. Common types include:

Proforma Budgets

A budget projects annual revenue and expenses, forecasting spending based on historical financial data and expectations for the fiscal year. Budgets guide organizations in resource allocation, financial management, cost savings, investment decisions, and growth strategies by analyzing past trends.

Pro Forma Company Income Statements

A pro forma income statement highlights specific metrics in a company’s quarterly earnings report. It presents both actual sales and expenses for the previous quarter alongside estimates for the current quarter, predicting future performance based on past data and anticipated changes.

Pro Forma Earnings Forecasts

A pro forma income statement also provides insights into a company’s internal financial assessment regarding planned changes, such as acquisitions or mergers, by disclosing their potential impact on earnings and expenses.

Pro Forma Financial Accounting

Pro forma financial accounting reports exclude nonrecurring activities, omitting expenses such as deteriorating investment values, restructuring costs, and accounting error corrections from previous years.

Pro Forma Management Accounting

Accountants create pro forma financial statements before acquisitions, mergers, capital structure changes, or capital investments. The pro forma income statement estimates transaction outcomes, predicting net revenues, cash flows, and taxes. Management uses these statements to evaluate the pros and cons of planned actions.

Pro Forma Statement Limitations

Investors should note that pro forma financial statements may contain calculations that do not adhere to GAAP standards, which public corporations use for financial reporting. These statements can vary significantly, sometimes altering GAAP numbers to emphasize operational performance.

In the late 1990s, some dot-com companies used pro forma financials to present losses as gains or inflate profits beyond U.S. GAAP standards. The SEC has mandated that publicly traded corporations report U.S. GAAP-based financial reports, warning against using pro forma results to mislead investors, which is both deceptive and illegal.

Creating a Pro Forma Statement

Basic pro forma income statement templates are available online, and tools like Microsoft Excel can automate entry and calculation based on user inputs. Alternatively, you can manually create a pro forma financial statement by following these steps:

Revenue Estimation

Analyze industry and market trends to make realistic revenue estimates. Consider market size, competition, pricing, and demand projections. Consulting with industry experts or market analysts can provide valuable insights.

For instance, if starting a software development company, estimate revenue from software licenses, subscription fees, or consulting services, considering client acquisition, renewal, and upsell rates. Be conservative in estimation, avoiding overestimation, and set realistic goals based on market conditions and company capabilities.

Estimate Costs and Liabilities

List all business costs and liabilities in a pro forma. This includes fixed and variable costs like:

- Rent or lease for office space or facilities

- Utilities such as electricity, water, and internet

- Employee salaries and benefits

- Insurance costs

- Licenses and permits

- Materials or inventory costs

- Marketing and advertising expenses

- Taxes

For example, starting a retail business may require storefront rent, employee pay, inventory, utilities, insurance, and marketing expenses. List outstanding loans and lines of credit as liabilities, considering interest and repayment periods when evaluating cash flow.

Revenue Forecasts

After estimating revenue and expenses, develop a pro forma income statement to forecast net income. This pro forma income statement should include predicted revenue, costs, and net profits.

Example:

Net income = Total Revenue - Total Expenses.

Use reasonable assumptions and cautious estimates to ensure accurate projections. It’s safer to underestimate revenue or overestimate expenses than the opposite.

Forecast Financial Flow

Create a pro forma cash flow statement to estimate the net cash impact of business activities. Your cash situation will change over time as your business operations evolve.

While the income statement uses accrual accounting, the cash flow statement records actual cash flows, including sale profits, supplier payments, operational expenses, loan repayments, and other cash activities. Forecasting cash flow helps anticipate cash shortages or surpluses and informs sensible business financial decisions. Pro forma forecasting estimates revenue, expenses, liabilities, net profits, and cash flow. Use practical assumptions, consult professionals, and proceed cautiously for accurate financial estimates.

The Difference Between Pro Forma and GAAP Financials

Proforma financial earnings and GAAP earnings are distinct methods of financial reporting. Publicly traded organizations must report their economic performance using GAAP earnings, while pro forma earnings are non-GAAP measurements providing adjusted or hypothetical financial figures.

GAAP results are regulated by accounting standards boards and regulators to ensure consistency, transparency, and accuracy in financial reporting. Financial statements must report revenue, expenses, assets, liabilities, and other economic factors according to specific standards. Investors rely on GAAP results to evaluate a company’s finances.

On the other hand, companies use pro forma earnings to exclude one-time expenses, nonrecurring items, and accounting anomalies. Pro forma earnings can be adjusted or misunderstood but may provide insights into a company’s operating performance or prospects. Companies can include or exclude elements in their pro forma calculations, leading to potential discrepancies. Investors must understand both pro forma and GAAP earnings.

When used cautiously, pro forma earnings can offer additional context or insights into a company’s financial performance, while GAAP earnings remain standardized and regulated. Investors should examine pro forma earnings adjustments to assess whether they accurately reflect the company’s economic status.