Roth IRA vs. 401(k) – Can You Really Benefit From Having These Retirement Plans?

When planning for retirement, it’s natural to question the most effective methods for maximizing your savings. Many individuals utilize retirement funds like the 401(k) and Roth IRA, each offering distinct advantages. The 401(k) is typically provided through employers, while the Roth IRA is a personal account allowing for contributions after taxes have been paid. This article will clarify how both accounts function, whether you can possess a Roth IRA and 401(k) concurrently, and the potential advantages of using them together for retirement savings.

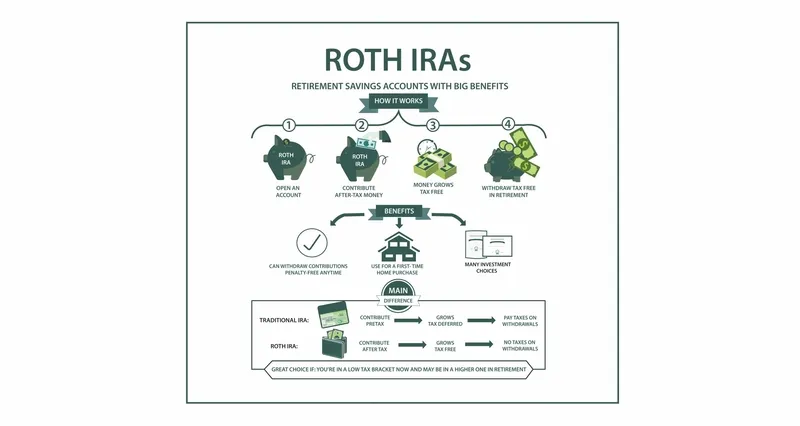

The Basics of a Roth IRA

A Roth IRA is a retirement savings account where contributions are made with after-tax income. This means that taxes are already paid on the amounts you contribute, and as your investments grow, they aren’t taxed again. When it’s time to retire and take qualified distributions, these too will be tax-free. However, a Roth IRA has specific rules individuals must meet based on their annual income.

Additionally, there is an annual limit set for contributions you can make to this account. Unlike traditional retirement accounts, Roth IRAs do not require minimum distributions (RMDs), allowing you to keep your funds in the account for as long as desired.

- Contribution Limits: The Roth IRA contribution limit can change each year, so it’s important to stay informed.

- Income Eligibility: There are income limits for eligibility, and contributing beyond those limits can result in penalties.

The Basics of a 401(k)

A 401(k) is a retirement savings plan offered by many employers. It differs from a Roth IRA because contributions to a 401(k) are typically made with pre- tax dollars, reducing your taxable income in the year you contribute. The account grows tax-deferred, meaning taxes are paid when withdrawing funds during retirement.

There are two main types of 401(k) plans: traditional and Roth 401(k). Contributions to a traditional 401(k) reduce your taxable income, whereas contributions to a Roth 401(k) are made after taxes, similar to a Roth IRA, allowing for tax-free withdrawals upon retirement. Employers may also offer matching contributions, which is an additional benefit.

- Employer Matching: Many employers offer matching contributions, significantly boosting your savings.

- Loan Option: Some 401(k) plans allow loans, providing access to funds if needed before retirement.

Can You Contribute to Both a Roth IRA and a 401(k)?

Yes, you can contribute to both a Roth IRA and a 401(k) simultaneously. There are no restrictions preventing you from holding both types of accounts, but there are limits on how much you can contribute to each. The annual contribution limit for a 401(k) is typically higher than that of a Roth IRA.

The Roth IRA contribution limit is usually lower and depends on your income level. However, if you have a 401(k) through your employer, opening and contributing to a Roth IRA might still be possible, provided you meet the necessary income criteria.

- Contribution Limits: Be aware of the contribution limits for both accounts to avoid penalties.

- Eligibility for Roth IRA: Eligibility for contributing to a Roth IRA is income-dependent, and high earners may not qualify.

How Contributions to Both Accounts Impact Your Taxes

A key difference between a Roth IRA and a 401(k) is their impact on your taxes. Contributing to a 401(k) can reduce your taxable income for the year, potentially lowering your immediate tax burden. In contrast, Roth IRA contributions are made with after-tax dollars, providing no immediate tax relief.

However, when you start withdrawing money from your retirement savings, distributions from a Roth IRA are tax-free, unlike 401(k) withdrawals, which are taxed as ordinary income. Owning both accounts can be beneficial due to tax-deferred growth and tax-deductible contributions. This strategy helps manage your tax obligations during retirement.

- Tax Strategies: A combination of accounts can help manage taxes more effectively, depending on future tax rates.

- Tax Bracket in Retirement: Consider how your income in retirement will impact your tax bracket when deciding on contributions.

The Benefits of Having Both a Roth IRA and a 401(k)

Having both a Roth IRA and a 401(k) offers flexibility in retirement planning. The tax-free withdrawals from a Roth IRA are advantageous, especially if you’re in a higher tax bracket during retirement.

On the other hand, the increased contribution limits of a 401(k), especially with employer matching, provide an opportunity to diversify your retirement savings. The tax-deferred growth of the 401(k) complements the tax-free growth of a Roth IRA, creating a balance that supports both current tax savings and future financial needs.

- Increased Savings Potential: Combining two accounts can enhance your overall retirement savings.

- Flexibility in Withdrawals: With both accounts, you can choose the most tax-efficient strategy for withdrawals in retirement.

Considerations When Managing Both Accounts

While owning both a Roth IRA and a 401(k) can be beneficial, proper management of these accounts is crucial. Monitor the maximum contribution limits for each account to avoid exceeding IRS restrictions. Additionally, your income may affect your ability to contribute fully to a Roth IRA, as earning too much could limit your contribution capacity.

When contributing to both a Roth IRA and a 401(k), consider your overall retirement strategy. Depending on your circumstances, focusing more on one type of account may be advantageous. For instance, if your employer offers a matching contribution for your 401(k), prioritizing this account to leverage the employer’s contribution might be wise.

- Maximize Employer Match: Always contribute enough to your 401(k) to receive the full employer match.

- Income-Phase-Out: High earners may face phased-out eligibility for Roth IRA contributions, limiting their ability to contribute.

Conclusion

In conclusion, owning both a Roth IRA and a 401(k) can be an effective strategy for retirement savings. By understanding the features and limitations of each account, you can maximize tax benefits to boost your retirement funds. Whether you’re just starting your career or nearing retirement, contributing to both types of accounts can help ensure a more secure financial future with efficient tax management.