Understanding Mortgage Amortization: Plan Your Loan Payments for Optimal Results

Mortgage amortization is a pivotal component of home finance, guiding borrowers through the structured repayment of their home loans. By amortizing a mortgage, you gradually reduce the loan balance through scheduled monthly payments that cover both the principal and interest. This arrangement provides borrowers with payment stability and a clear timeline for when they will fully own their home. In this article, we’ll delve into the workings of mortgage amortization, explore how it impacts mortgage costs, and offer insights for borrowers on managing this process effectively.

How Does Mortgage Amortization Work?

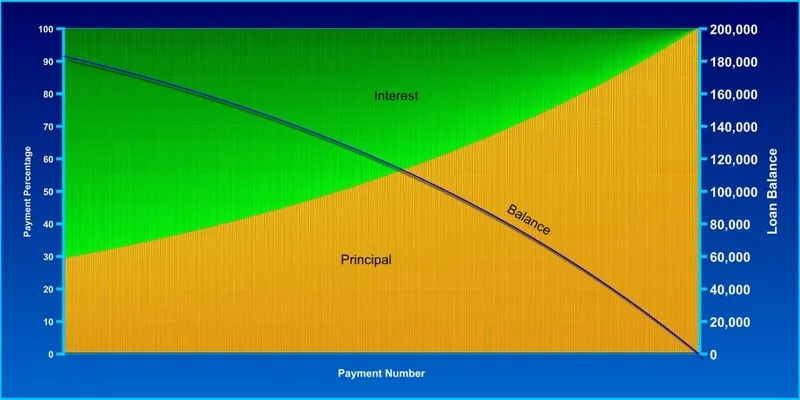

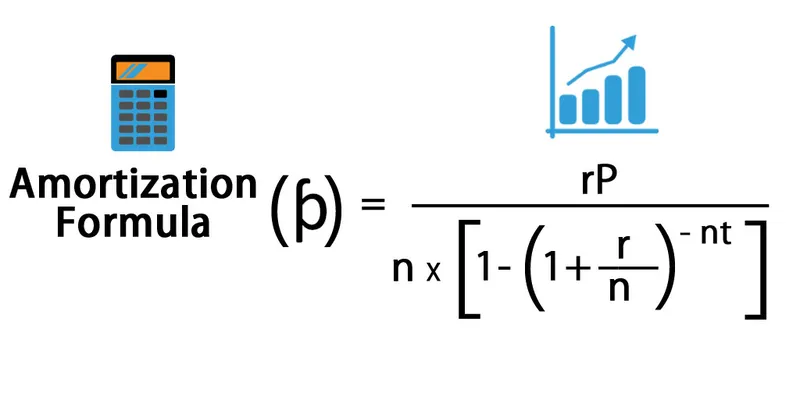

Mortgage amortization is based on a predetermined payment plan, dividing each payment into the loan principal and interest components. During the early stages of a mortgage, most payments are applied toward interest because the outstanding balance is still high. Over time, a larger portion of each payment goes toward reducing the principal, which gradually lowers the interest charged.

This shift allows borrowers to make progress in paying off their principal while reducing interest expenses. Understanding this method can help borrowers see the effects of each payment and plan for future financial conditions.

- Payment Distribution: Early payments focus on interest, which gradually decreases as more is applied to the principal.

- End of Term Goal: Amortization ensures full loan repayment by the end of the mortgage term, balancing costs over time.

The Role of the Mortgage Amortization Schedule

A mortgage amortization schedule is a detailed table showing the distribution of each monthly payment throughout the loan’s term. It clearly illustrates how each payment is divided between interest and principal. This schedule helps borrowers anticipate interest costs and track their progress toward complete homeownership.

Many borrowers consult this schedule to understand the total interest they will pay over the loan’s duration. This information is crucial when considering options like refinancing or making additional payments toward the principal.

- Transparency in Payments: The schedule allows borrowers to see their payment’s exact breakdown between interest and principal.

- Planning Aid: An amortization schedule helps in planning extra payments to reduce interest and shorten loan terms.

Understanding Loan Principal and Interest Payments

The initial amount borrowed for a home purchase is the loan principal, while interest refers to the cost of borrowing that principal over time. Mortgage payments typically include both principal and interest components, gradually reducing the overall debt.

With a fully amortizing loan, by the end of the mortgage term, you’ve paid off the entire balance. Borrowers who understand these elements can make informed financial decisions, such as paying extra on the principal or opting for shorter loan terms to cut down on interest costs.

- Principal Impact: Paying extra toward the principal can shorten the loan term and reduce interest costs.

- Interest Savings: Choosing a shorter term can result in significant interest savings over the life of the loan.

How Interest Rates Affect Mortgage Amortization

Interest rates significantly impact the cost of a mortgage and its amortization structure. High interest rates mean more of each payment initially covers interest, reducing the principal impact. Conversely, lower interest rates enable a quicker reduction in principal, allowing borrowers to repay their mortgage sooner.

Fixed-rate mortgages provide stability with regular payments, while adjustable-rate mortgages (ARMs) can have varying interest rates, affecting the amortization schedule and total interest paid.

- Rate Impact: Higher rates slow down principal repayment, increasing the loan’s total cost.

- Fixed vs. Adjustable: Fixed rates offer payment consistency, while adjustable rates may vary over time.

Benefits of Understanding Mortgage Amortization

Understanding mortgage amortization provides a predictable and straightforward path to homeownership, offering peace of mind as borrowers know when they will be debt-free. This process also offers opportunities to save on interest by making extra payments toward the principal.

By understanding how amortization works, borrowers can effectively manage their repayments, consider refinancing options, and ultimately reduce loan costs. Informed borrowers feel empowered to make decisions that align with their financial goals.

- Financial Clarity: Knowing the amortization process aids in financial planning and decision-making.

- Cost Reduction: Understanding amortization allows borrowers to explore options to reduce total loan costs.

Strategies for Managing Mortgage Amortization Efficiently

Homeowners can take advantage of strategies to optimize mortgage amortization, such as making additional payments to reduce the principal balance. These extra payments shorten the loan term and decrease the interest paid over time. Refinancing to a lower interest rate or choosing a shorter term can also streamline the amortization process and save money in the long run.

Understanding these strategies helps borrowers maximize their mortgage benefits and reduces the financial burden of homeownership, making the journey to full ownership more affordable and manageable.

- Refinancing Benefits: Refinancing at a lower rate can shorten the term and reduce overall interest costs.

- Extra Payments: Regular extra payments toward the principal can significantly cut down loan duration and expenses.

Conclusion

In conclusion, mortgage amortization is more than just a payment system; it equips homeowners with strategies for achieving greater financial freedom by efficiently managing their mortgage payments. By leveraging knowledge of amortization, borrowers can make informed decisions that support their long-term financial objectives and pave the way to complete homeownership.