A Guide to Credit Report: Definition, Making, and Working of Credit Reports

It’s not easy to prove your financial trustworthiness, but a credit report can be an effective way to do this. A favorable credit report indicates insightful financial handling and a healthy lifestyle, easing your way to achieving future goals.

Curious about how to get a credit report? Search no more! This article is your complete guide to assembling your credit report yourself.

What is a Credit Report?

Have you ever noticed that when you apply for a loan or a scholarship, authorities require your credit history and score? If you prepare a credit report beforehand, your financial document problems will be sorted. A credit report is a compilation of your borrowing history from banks, credit card companies, and the government. This history is assembled and stored as user- friendly data by one of the following consumer credit bureaus:

- Equifax

- TransUnion

- Experian

What Does a Credit Report Include?

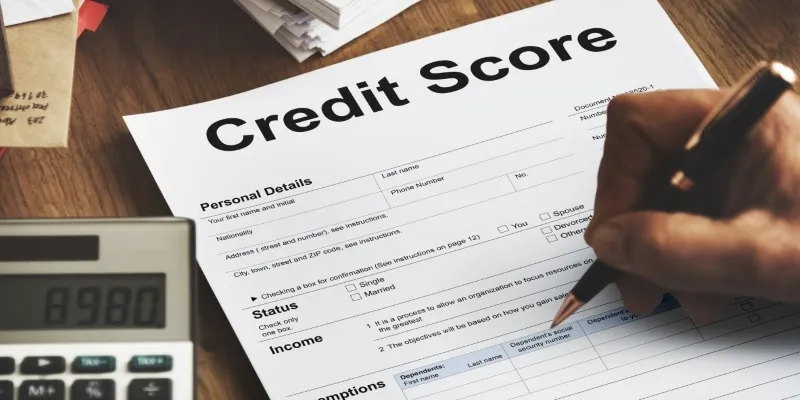

Now that you understand what a credit report is , let’s look at what’s included in it. Your credit report consists of the following credentials:

Personal Information

The first section of your credit report consists of your personal information, mainly including:

- Your full name

- CNIC

- Your permanent address

- Permanent phone number

- Social security numbers

- Any credit partners

- Past and current employers

- A personal statement that justifies you for late payments or increasing debts

Banking Details

The second section details your banking activities, including:

- Opening date

- Account details

- Payment history

- Revolving or interest debt

This information is included under the accounts section with great responsibility.

Collection Account Information

If you become over-indebted and cannot pay back your credits, your account may be bought by collection agencies. Your credit report will show this information. The presence of collection accounts devalues your report as it indicates irresponsible credit handling.

Public Records

All types of recorded bankruptcies, liens, and civil judgments directly or indirectly related to you are mentioned in the public record section of the credit report. Also, the date of issuance and the court name are included. This section can negatively impact your credit history if filled with bankruptcies and lawsuits.

These public records remain on your credit report for at least seven years. An adverse credit report may create difficulties in obtaining loans and future mortgages.

Inquiry Reviews

Two types of inquiries are indicated at the end of the credit report:

Soft Inquiry

Sometimes, unknown agencies view and use your credit report for marketing purposes. This is called a soft inquiry and is noted in your credit report without harmful intentions.

Hard Inquiry

A hard inquiry occurs when taxation and law firms review your credit report to check your paid and remaining credits. Banks and governments do this to keep track of unpaid debts. Hard inquiries can negatively affect your financial status.

How to Get a Credit Report?

To obtain a credit report , seek assistance from credit bureaus like Equifax, Experian, or TransUnion. They have databases designed to collect your information. Here’s how:

- Send your information to a credit bureau, e.g., via your Equifax account.

- The bureau will sort out your public records, collection accounts, and other banking data.

- Using the collected data, the credit bureau presents you with your credit report. You can update your account, see any changes made by authorities, or follow up with your accounts through the credit bureaus for free.

Is Your Information in the Credit Report Safe?

Yes, credit bureaus keep track of anyone who accesses your information. Moreover, only authorized individuals can access your personal information with permission. Any company or organization wanting your credentials must register with the credit bureau first.

Not all companies are registered by credit bureaus. A thorough evaluation considers the purpose of the company’s investigation before registration. Bureaus also verify validity and privacy policies to protect you from fraud.

Credit Report’s Impact on Your Life

Did you know that credit history affects your daily life in many ways? Here are some ways credit reports can impact your life:

Renting a Place

Your landlord or leasing company may check your credit report before renting you a house or apartment. If your credit history is not up to the mark, your request might be declined. However, timely rental payments can positively affect your credit score.

Mobile Service

If you switch mobile services or get a new phone, your application might be declined due to late payment issues mentioned in your credit record, or you might need to make a larger deposit. Conversely, a favorable credit report might exempt you from down payments and offer an easy installment plan.

Paying Bills

Many utilities and mobile companies are registered with credit bureaus. Your billing time and amounts are directly reported to the bureaus, affecting your credit report.

Job Applications

Your current and past employers can analyze your credit report before hiring you. A responsible credit history with a positive credit score can help you secure a decent job. A poor credit report may hinder your career opportunities.

Bottom Line

Your credit report is a summary of all your credited transactions and financial records. It enables lenders to make well-informed choices about a borrower’s creditworthiness through a system of checks and balances.

You can obtain your credit report by providing the necessary information to any legally operating credit bureau. Credit reports also affect your daily life, making future transactions easier if you demonstrate financial responsibility. Otherwise, they might negatively impact your credit score, future transactions, and credibility.