Credit Cards for Building Credit: Best Practices for Financial Beginners

To achieve financial goals such as buying a home or securing a loan, establishing a strong credit history is essential. One effective way to enhance your credit rating is through the responsible use of a credit card. When managed correctly, a credit card can be a straightforward tool for building good credit. This article explores how using a credit card can aid in constructing your credit and boosting your credit score.

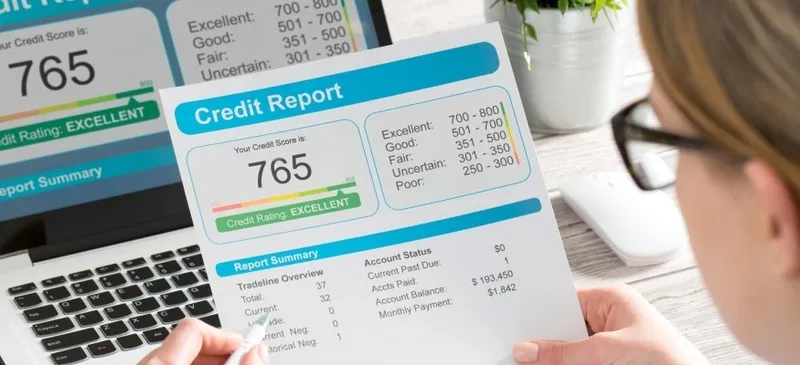

How Credit Cards Affect Your Credit Score

Your credit score is determined by several factors, with payment history and credit utilization being crucial elements. Using a credit card directly affects these components. Timely credit card payments demonstrate to lenders that you manage credit responsibly. Conversely, high balances or missed payments can negatively impact your credit score. Consistent usage and proper management of your credit card balance can gradually increase your credit score.

- Credit Bureaus: Ensure your credit card issuer reports to all major credit bureaus for an accurate reflection of your credit activity.

- Long-Term Effects: A higher credit score can lead to lower interest rates on future loans or credit cards.

The Importance of Timely Payments

A vital aspect of building your credit score is your payment history. Credit card companies report your payment activities to major bureaus like Equifax, Experian, and TransUnion. Regular on-time payments can significantly enhance your credit standing. To avoid missing due dates, it’s important to set reminders or automatic payments. A missed payment can stay on your credit report for up to seven years, so staying current is crucial for establishing a positive credit history.

- Payment History: Your payment history accounts for about 35% of your credit score, making it the most influential factor.

- Late Payments: Even a single late payment can significantly lower your score and remain on your credit report for years.

Maintaining Low Credit Utilization

Credit utilization refers to the portion of your available credit you’re using. For example, if you have a credit limit of $1,000 and owe $300, your credit utilization is 30%. This factor plays a significant role in determining your overall credit score. It’s generally recommended to keep your credit utilization ratio below 30% since a high ratio can negatively impact your score. By spending only what you can pay off each month, you can maintain a low utilization rate and improve your credit score.

- Balance Management: If possible, pay off your balance before the statement date to keep your credit utilization low, even if carrying a balance.

- Card-Specific Utilization: Credit utilization is calculated for each card, so it’s essential to keep balances low on all cards.

Choosing the Right Credit Card

Selecting the right credit card is crucial for building credit. If you’re new to credit or have a poor credit score, starting with a secured credit card might be wise. These cards require collateral in the form of deposits but function like regular credit cards. Once you establish a good payment history, you can transition to an unsecured credit card with better terms. Research various options to find one with minimal fees and a reasonable interest rate to simplify credit management.

- Secured vs. Unsecured Cards: If you’re new to credit, consider starting with a secured card to build your credit and later transition to an unsecured card.

- Interest Rates: Compare credit cards with low-interest rates to avoid high interest payments.

The Role of Credit Limits in Building Credit

Your credit limit plays a significant role in your credit utilization ratio. If you consistently pay on time, credit card issuers may periodically review your account and increase your credit limit. While it might be tempting to use more credit, it’s essential to maintain disciplined spending habits. Increasing your credit limit can benefit your credit score if you continue to use only a small portion of the available amount. However, excessive spending can quickly lead to high debt and increased balances, harming your credit score.

- Increase Gradually: Don’t rush to use the extra credit limit; maintain low balances to benefit from an increased credit limit.

- Monitor Utilization: Track your utilization rate to ensure you’re staying below the recommended 30%.

Avoiding Common Pitfalls When Using Credit Cards

While credit cards can help build your credit, they also present potential pitfalls that could hinder your progress. A common mistake is making only the minimum payment. While this keeps a positive relationship with your card provider, it results in paying more interest over time. Another mistake is opening multiple credit accounts in a short period. Each hard inquiry on your credit report can temporarily lower your score. By being aware of these pitfalls, you can ensure that using your credit card aids in improving your credit score instead of harming it.

- Pay More Than Minimum: Paying only the minimum amount on your credit card results in higher interest payments and prolongs your debt.

- Hard Inquiries: Avoid applying for multiple credit cards in a short period, as each hard inquiry can slightly lower your score.

Conclusion

Proper credit card use is one of the best ways to build your credit and enhance your financial future. By paying on time, maintaining low balances, and selecting a card that aligns with your needs, you can establish a positive credit history that will serve you well for years to come.