Last-Minute College Fundings – Creative Ways to Cover Tuitions, Fees, and More

Funding a university education can be challenging, especially when you’re up against tight deadlines. Many students find themselves in situations where they must secure funds at the last minute. This could be due to late application submissions or unexpected financial needs. It’s essential to explore all potential options to cover your expenses. This article provides a comprehensive guide on urgent ways to finance your college education, with a focus on immediate financial assistance options and strategies to help you afford university quickly.

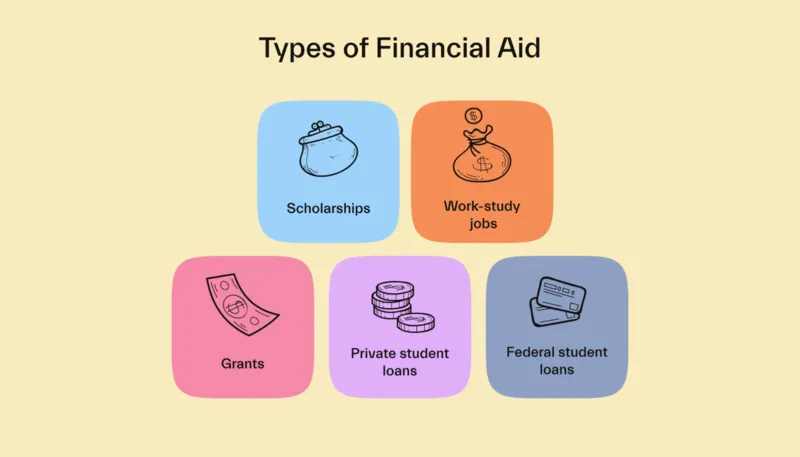

Explore Federal Financial Aid Options

Federal financial aid is a reliable source of funding for college students. We recommend applying as soon as possible by completing the Free Application for Federal Student Aid (FAFSA). This form can unlock opportunities such as federal grants, work-study programs, and student loans. Even if the academic year is underway, there is still time to submit your FAFSA.

Each school has its own deadlines, but generally, your federal aid application will be considered if submitted before the academic year ends. If you miss the initial deadline, there may still be opportunities for financial assistance in the next term. It’s beneficial to consult with your financial aid office about urgent funding or additional aid packages that might be available.

- Emergency FAFSA Deadlines: Some schools extend FAFSA deadlines, so contact your financial aid office for details.

- Grant Options: Federal grants, such as the Pell Grant, are available to eligible students and do not require repayment.

Look Into Private Student Loans

If you need money quickly, private student loans can be an option. While federal loans typically offer more favorable interest rates and repayment terms, private loans can provide the necessary funds when time is of the essence. Many banks, credit unions, and online lenders offer private student loans, and applications often yield results within a few days.

It’s important to note that private loan interest rates may be higher than federal ones. If you lack a strong credit history, a co-signer might be necessary. Before choosing any private loan option, compare rates and terms from multiple lenders.

- Cosigner Considerations: A cosigner can improve your loan approval chances if you have limited credit history.

- Loan Comparison: Take time to compare private loan terms, as rates and repayment terms can vary widely between lenders.

Utilize Emergency Scholarships

Many colleges and universities offer emergency scholarships for students facing financial hardships. These scholarships provide immediate assistance to students in urgent need. Some may have specific criteria, such as sudden medical expenses, while others may be open to all students who can demonstrate financial need.

Typically, information about emergency scholarships can be found by contacting your school’s financial aid office or visiting their website. Some institutions also reserve special funds for students in financial crises, so it’s worth inquiring about such options.

- Discretionary Funds: Some schools have funds specifically designated for urgent financial needs.

- Special Circumstances: Scholarships may be available for students in specific situations, such as illness or family emergencies.

Consider Crowdfunding for College Expenses

If traditional funding methods fall short, consider crowdfunding as a way to raise money for college. Crowdfunding platforms like GoFundMe allow individuals to create fundraising campaigns to help pay for tuition and related expenses.

While success is not guaranteed, crowdfunding can be a powerful tool for gaining support from family, friends, or even strangers willing to contribute to your education. To improve your chances, clearly describe your situation and promote your campaign through social media and personal networks.

- Social Media Promotion: Sharing your crowdfunding campaign on social media can increase visibility and attract donations.

- Campaign Transparency: Be clear about your financial needs and how the funds will be used to encourage donations.

Check for Employer Assistance Programs

Some employers offer tuition reimbursement or assistance programs to help employees cover college costs. If you’re currently employed, check if your employer provides any tuition assistance programs. Many companies offer this benefit as part of their employee benefits package, often available to both full-time and part-time staff.

These programs may require meeting certain criteria or committing to remain employed with the company for a specified period after graduation, but they can significantly reduce your education expenses. If tuition assistance is available through your job, apply as soon as possible to take advantage of this funding source.

- Eligibility Requirements: Employer assistance programs may have specific eligibility criteria, so review your company’s policies.

- Commitment to Employer: Some programs require you to work with the employer for a certain period after graduation to receive full reimbursement.

Explore Short-Term Loans or Credit Options

Short-term loans or credit facilities can sometimes help cover costs when you need to arrange college payments quickly. Financial institutions offer personal loans that can be applied toward education expenses. These loans usually require repayment over a shorter period and may have higher interest rates compared to student loans. However, they can provide the immediate cash you need.

Alternatively, some students use credit cards for educational fees or school- related expenses. Exercise caution with credit cards, as they may carry high interest rates, especially if balances are not paid off promptly. If you choose to use credit cards or short-term loans, have a repayment strategy in place.

- Credit Card Interest: Be aware of high interest rates on credit cards, especially for unpaid balances.

- Loan Terms: Short-term loans may have faster approval times but can come with higher interest rates than traditional student loans.

Talk to Your School’s Financial Aid Office

When time is running short, your school’s financial aid office can be an invaluable resource. Financial aid officers can guide you on how to secure funds and may offer suggestions or alternative ways to secure last-minute funding. They might also extend deadlines, assist with emergency fund applications, or propose tuition payment plans.

If you’re struggling to afford college and need urgent help, don’t hesitate to contact your school’s financial aid office. They can direct you to additional resources, such as local grants or community scholarships that might provide further financial assistance.

- Emergency Aid Options: Your financial aid office may have emergency funds available to assist with immediate costs.

- Local Resources: Financial aid officers may also know of local scholarships and grants not widely advertised.

Conclusion

If you face financial challenges as a college student, numerous immediate funding options can assist you. It’s crucial to explore all available resources, from federal financial aid and private loans to emergency scholarships and employer assistance programs. Although securing last-minute funding can be stressful, with the right approach, it is possible to quickly cover university costs and continue your education without interruption. Be proactive, seek help when needed, and take every opportunity to reduce the financial burden of your college experience.