What is Fundamental Analysis? Understanding Its Role in Financial Decision-Making

In the world of investing, making informed decisions is key to achieving success. Investors often rely on various methods to evaluate potential opportunities. One of the most widely used methods is fundamental analysis. Whether you’re a seasoned investor or just starting, understanding the role of fundamental analysis can help you make smarter, more informed choices.

Unlike technical analysis, which focuses on price movements and trends, fundamental analysis digs deeper into a company’s financial health, its market position, and broader economic factors. But what exactly is fundamental analysis, and why is it so crucial for evaluating investments? In this article, we will explore the core concepts of fundamental analysis, its key components, and how it is used to assess stocks, bonds, and even entire markets.

What is Fundamental Analysis?

Fundamental analysis is the process of evaluating a financial asset to determine its intrinsic value. This value is assessed based on several factors, such as a company’s financial statements, industry position, market conditions, and the broader economic environment. Fundamental analysis aims to identify whether an asset is overvalued or undervalued, helping investors decide whether to buy, hold, or sell it.

For instance, when a fund manager considers buying or selling a company’s stock, they evaluate whether the stock is undervalued or overvalued. The analyst examines factors like revenue, earnings, growth potential, competitive advantages, and market trends. Additionally, they consider qualitative factors such as management team performance, debt levels, corporate governance, and industry dynamics. Unlike technical analysis, which relies solely on past price movements to forecast future trends, fundamental analysis offers a more comprehensive approach.

According to fundamental analysis, the correct value of an asset can be determined through a detailed study of quantitative and qualitative factors, allowing investors to make rational decisions based on the actual health and potential of a company or asset.

The Key Components of Fundamental Analysis

When conducting fundamental analysis, several core elements are considered to assess the true value of a financial asset. These components help investors understand the strength of a company or market and guide investment choices.

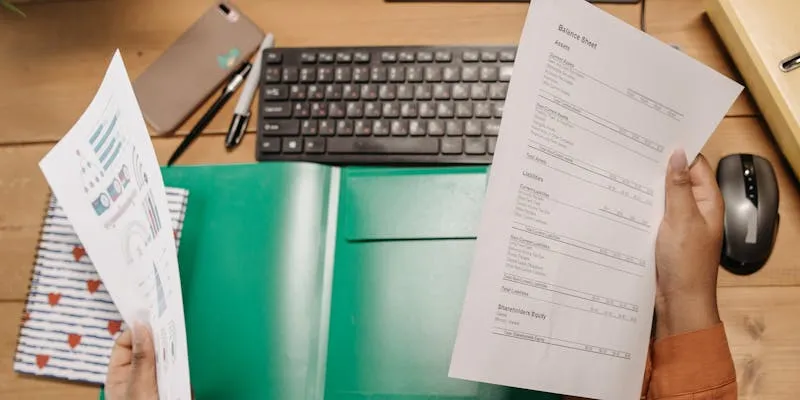

Financial Statements

Financial statements are the backbone of fundamental analysis. These include the income statement, balance sheet, and cash flow statement. They provide a detailed picture of a company’s financial health. The income statement shows profitability, the balance sheet reveals the company’s assets and liabilities, and the cash flow statement highlights the company’s ability to generate cash. By analyzing these statements, investors can assess key financial metrics like profitability, liquidity, and solvency.

Earnings and Growth Potential

Earnings are one of the most critical factors in determining a company’s value. Investors look at both current earnings and future earnings projections to assess a company’s growth potential. A company that consistently generates strong earnings is often seen as a good investment opportunity. Additionally, earnings growth is important because it indicates that a company is capable of expanding and increasing its profitability over time.

Management and Leadership

The quality of a company’s management team is another vital aspect of fundamental analysis. A strong leadership team with a clear vision and a proven track record can significantly impact the company’s long-term success. Analysts often assess the management team’s strategy, past performance, and ability to adapt to changing market conditions.

Industry and Market Conditions

In addition to analyzing a company’s internal factors, fundamental analysts also evaluate the external factors that could affect a company’s performance. This includes market trends, competition, and the overall health of the industry in which the company operates. Understanding the broader economic environment is crucial for evaluating the sustainability of a company’s growth prospects.

How Fundamental Analysis Helps in Stock Evaluation?

One of the most common uses of fundamental analysis is in evaluating stocks. For investors looking to invest in individual stocks, this method helps identify companies that are trading below their intrinsic value (undervalued) or above their true worth (overvalued).

Valuation Models

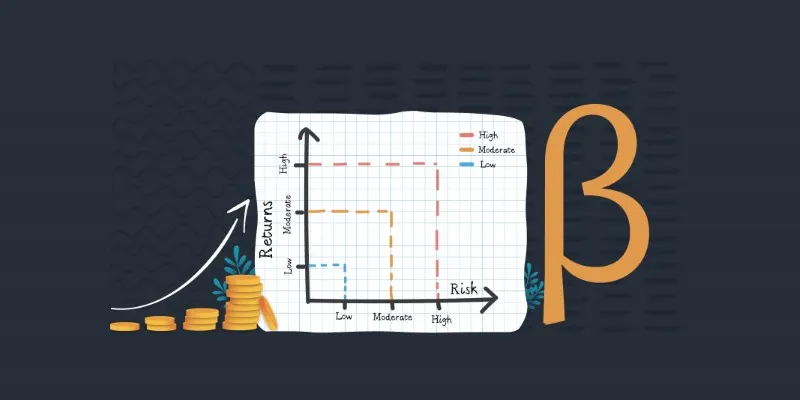

To assess whether a stock is fairly priced, fundamental analysts often use various valuation models, such as the Price-to-Earnings (P/E) ratio, the Price-to-Book (P/B) ratio, and discounted cash flow (DCF) analysis. These models help estimate the intrinsic value of a company’s stock by comparing its current market price with key financial metrics like earnings and book value.

For example, a stock with a low P/E ratio compared to its industry peers might be undervalued, while a high P/E ratio could indicate that the stock is overvalued. DCF analysis takes future cash flows into account, offering a more detailed valuation based on the company’s growth prospects.

Identifying Investment Opportunities

By applying fundamental analysis, investors can identify opportunities to buy stocks at a discount. If a stock is undervalued based on its fundamentals, it might be a good time to purchase. On the other hand, if a stock is overvalued, an investor might decide to sell or avoid purchasing it altogether. The goal is to find investments that offer long-term growth potential based on solid financials and industry trends.

The Role of Fundamental Analysis in Investment Strategies

Fundamental analysis plays a central role in shaping an investor’s overall investment strategy. It is particularly useful for long-term investors who seek to build a portfolio of fundamentally sound companies or assets. By focusing on the intrinsic value of investments, these investors are less likely to be swayed by short-term market fluctuations or speculative trends.

For value investors, fundamental analysis is critical for identifying stocks or other assets that are undervalued relative to their intrinsic value. By purchasing undervalued assets, value investors aim to capitalize on market inefficiencies.

Conclusion

In conclusion, fundamental analysis is a powerful tool for investors looking to make informed, data-driven decisions. By analyzing a company’s financial health, market position, and growth potential, investors can assess whether an asset is priced appropriately and identify opportunities for long-term growth. While it may require a more detailed and patient approach than technical analysis, the insights gained through fundamental analysis can significantly enhance an investor’s ability to navigate the complexities of financial markets.